Topics

- Urgent Help

- Sales Module

- Discuss

- Calendar

- Live Chat

- Website Manager

- Property Management System

- Room Servicing

- Extras

- Emails

- Creating Email Templates

- Selling Groups

- Customer & Companies

- Agents & Sales Channels

-

Rates

- Dynamic Rates

- Back End Setup Dynamic Rates

- Room Rate Selling Group Mapping

- Rate Calculation

- Back End Bookings

- Front Booking Screen Dynamic Rates

- Rates & Min Stays calendar screen

- What your Customers See

- Changing Rates - Guide

- Price Change Long Term

- Change Min Stay ( long term)

- Multiple Min Stay Prices

- Day of Week Price Variation

- Create New Rate

- Promo Codes

- Bookings

- Acquire Credit Card Details

- Make A Booking

- Full New Booking

- Cancel a Booking

-

Payments & Invoicing

- Invoice & Debtors

- Invoice Due Date

- Create Invoice

- Invoice Payments

- Reasign Invoice Payment

- Cancel / Amend Invoice

- Invoice Agents Comissions

- Invoice Journaling

- Reset Audit Errors

- Debtors

- Adding A Booking Payment

- Refund A Booking

- Charge Cancellation Fee

- Split Payments

- Customer & Company Account Trans

- Amend / Delete Booking Payment

- Reports

- Marketing Module

- Settings

Invoice Journaling

This enhancement will allow you to make changes to the rooms and/or extras of a booking even after the items have already been invoiced. For example, you may have a one day booking that has been invoiced but the customer now wants to stay another 2 days. Or you have sold a tour with your booking and invoiced it in advance, however the tour has now been cancelled. Until now, you would have needed to cancel the invoice, make the changes to the booking/extras, and then re-invoice (otherwise it would result in an audit error on the invoice).

You can now make changes to the booking/extras, and the initial invoice is unaffected. However on the invoice screen you will now see a reversal line created for the same value as the original invoice item. You will also see another line for the new amount (if it has been amended, not cancelled). These are called invoice journals and can be added to the original invoice or saved to a new invoice. This makes it much easier to invoice an agent for the initial booking but make changes to the booking after the arrival of the guest and invoice them separately for changes to the booking.

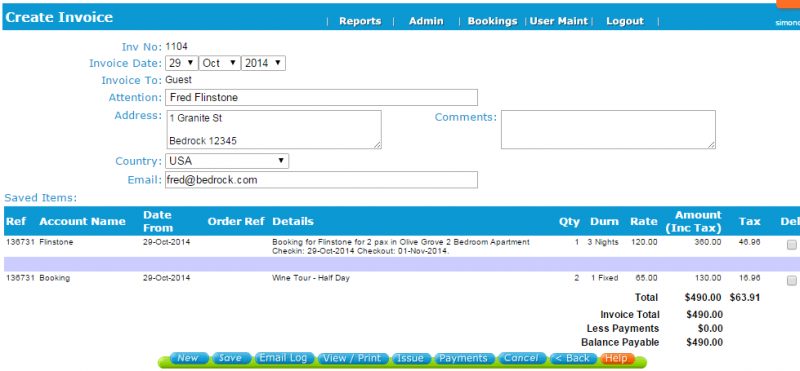

Below is an example of an invoice where the guest has been invoiced for a room and a tour.

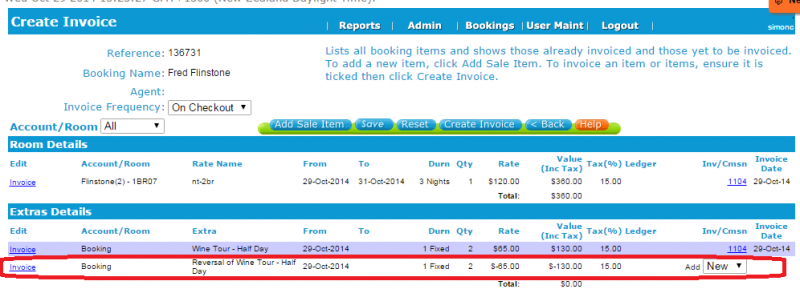

The tour has been cancelled, so the item is removed from the extras in the booking. The invoice screen will now change to the following:

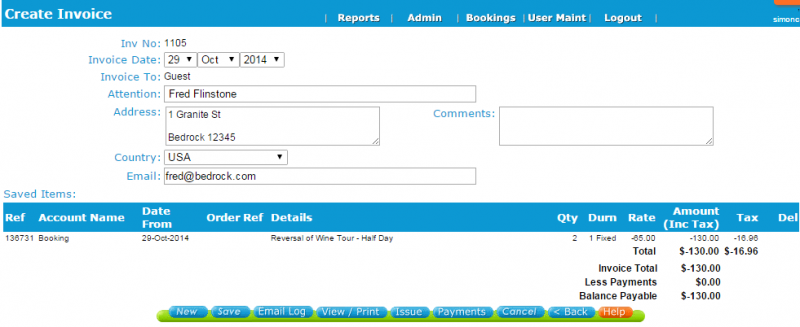

You will see that this change has resulted in a reversal being added as a new invoice option (as shown in red above). This reversal is the negative amount of the original extra, and has created a $0 balance for the extras. This new journal item can then be added to the existing invoice (by selecting the invoice number from the drop-down options) or it can be added to a new invoice (by selecting New in the drop-down options) and pressing Create Invoice. In the example below we have added it to a new invoice by selecting the New drop-down option, Create Invoice, and Save.

Note that it is important to invoice a journal and not leave it unassigned or it could create problems later. If you have a journal that you do not intend to invoice to the customer, assign it to a dummy invoice so that it does not complicate future invoice transactions on the booking. If a change has been made to an invoiced item, the booking balance may show a credit or an overdue amount if the journal has been left unattended.